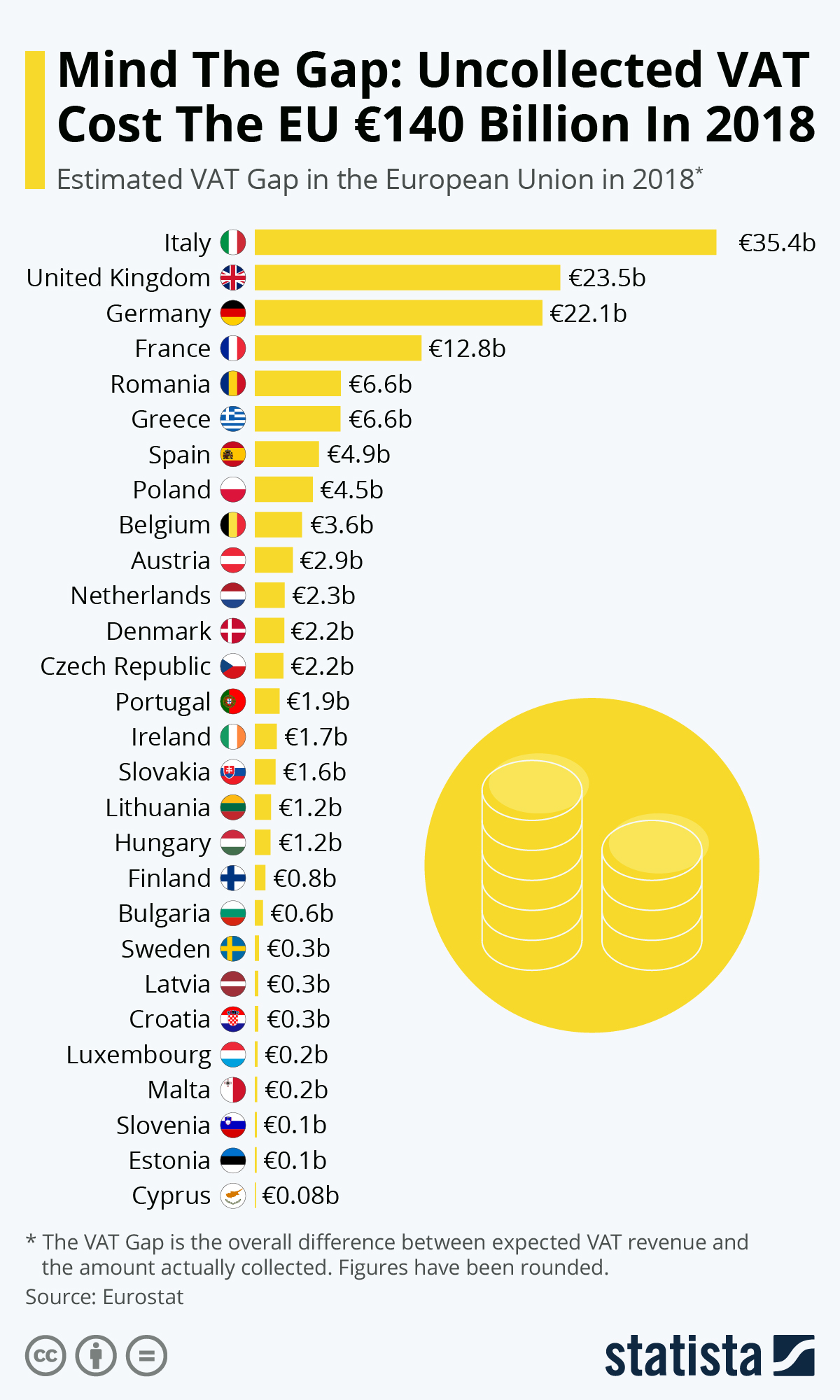

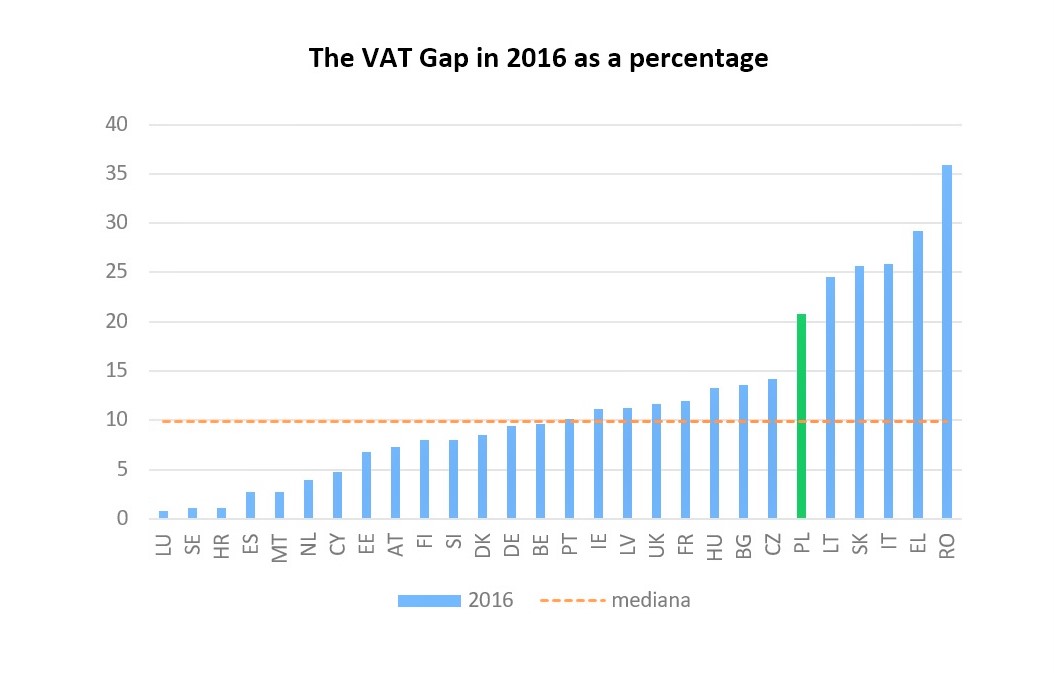

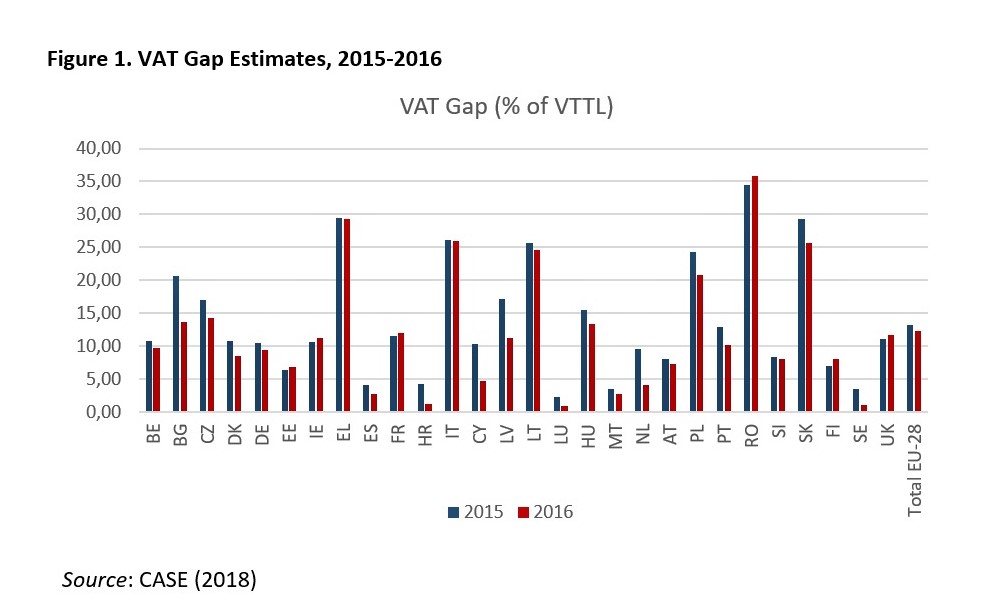

EUR 147.1 billion in VAT revenues was lost in 2016 in the EU - CASE - Center for Social and Economic Research

2. Estimation of the Determinants of VAT GAP. Fixed Effects Specification | Download Scientific Diagram

![PDF] Asesssing the Impact of Value Added Tax (Vat) Gaps on Vat Revenue Generation in Nigeria | Semantic Scholar PDF] Asesssing the Impact of Value Added Tax (Vat) Gaps on Vat Revenue Generation in Nigeria | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/b5bacbdd070ac126d7cbd65cac08474302ca5488/9-Table1-1.png)

PDF] Asesssing the Impact of Value Added Tax (Vat) Gaps on Vat Revenue Generation in Nigeria | Semantic Scholar

2. VAT Gap as a percent of the VTTL in EU-28 Member States, 2017 and 2016 5 | Download Scientific Diagram

![PDF] Asesssing the Impact of Value Added Tax (Vat) Gaps on Vat Revenue Generation in Nigeria | Semantic Scholar PDF] Asesssing the Impact of Value Added Tax (Vat) Gaps on Vat Revenue Generation in Nigeria | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/b5bacbdd070ac126d7cbd65cac08474302ca5488/10-Table2-1.png)

PDF] Asesssing the Impact of Value Added Tax (Vat) Gaps on Vat Revenue Generation in Nigeria | Semantic Scholar

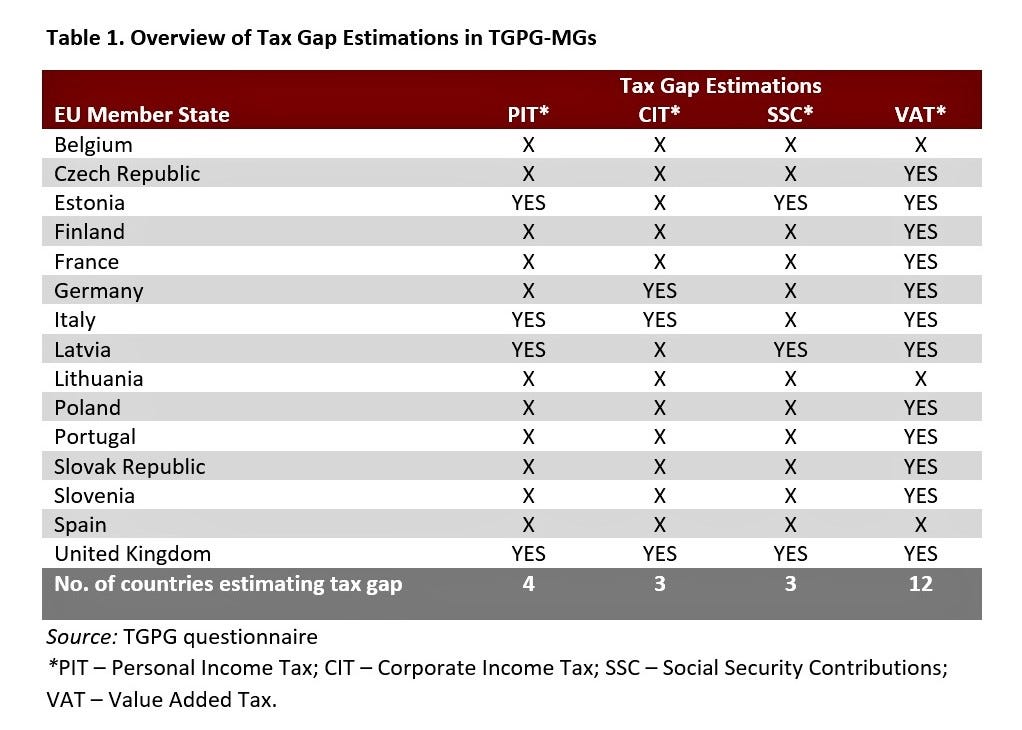

Before We Close Tax Gaps, We Have to Understand Them - CASE - Center for Social and Economic Research