Technical consultation on the draft Banks and Building Societies (Priorities on Insolvency) Order 2018 - GOV.UK

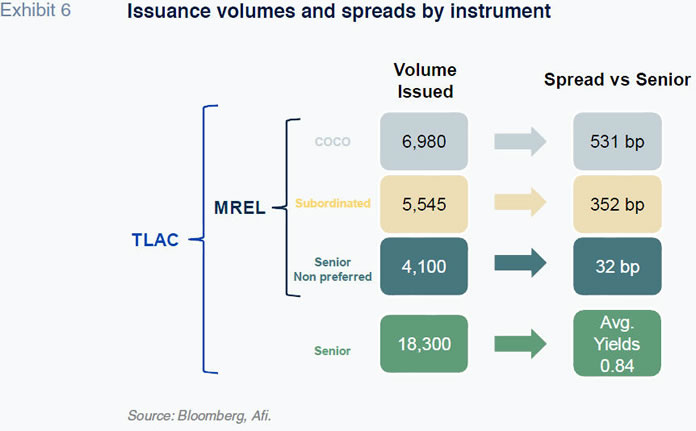

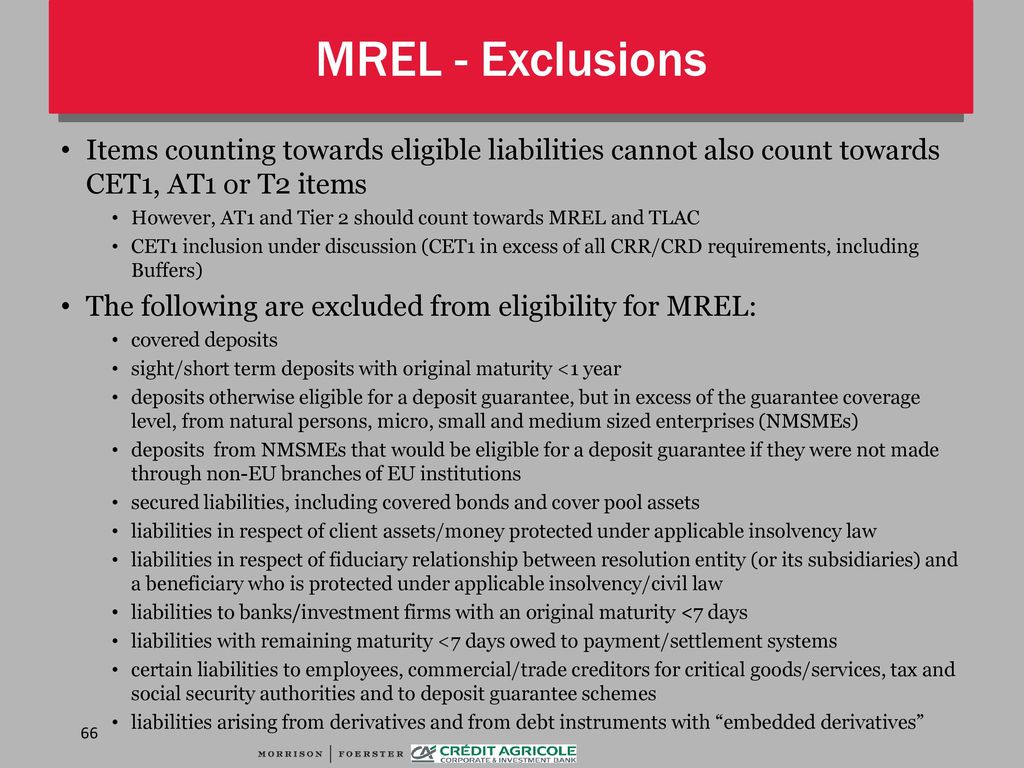

![サーファー on Twitter: "[#TFEU l #BRRD-#SRMR] #Eligibility of various classes of #financial #instruments under #MREL and #TLAC https://t.co/SAv6eeCe4i" / Twitter サーファー on Twitter: "[#TFEU l #BRRD-#SRMR] #Eligibility of various classes of #financial #instruments under #MREL and #TLAC https://t.co/SAv6eeCe4i" / Twitter](https://pbs.twimg.com/media/DBul-N9XgAAyq3F.jpg:large)

サーファー on Twitter: "[#TFEU l #BRRD-#SRMR] #Eligibility of various classes of #financial #instruments under #MREL and #TLAC https://t.co/SAv6eeCe4i" / Twitter

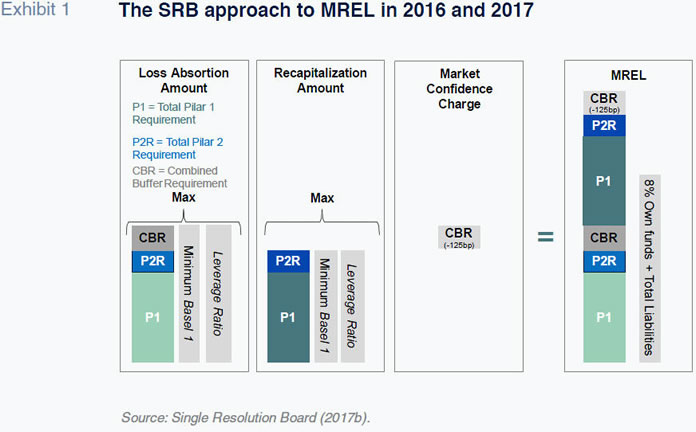

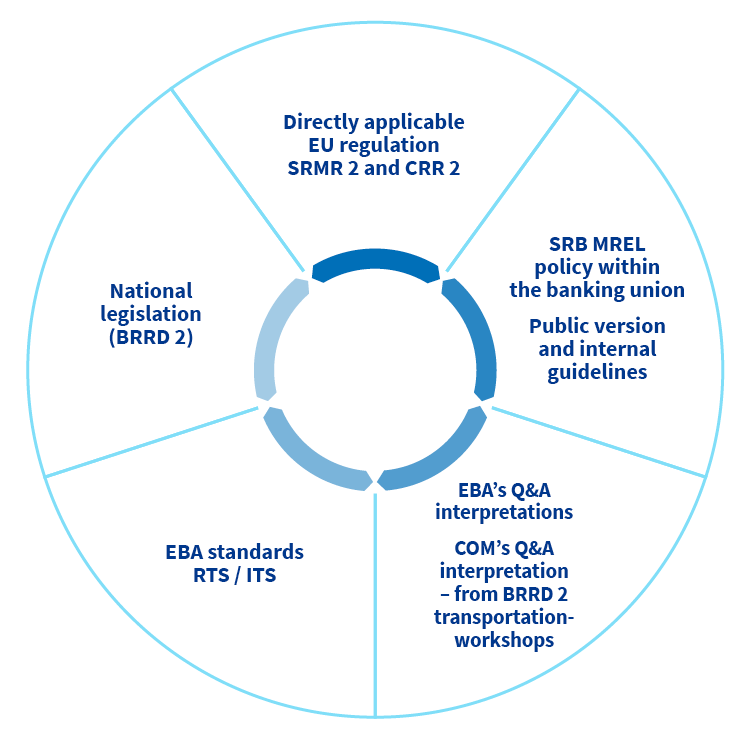

![PDF] Why MREL won't help much: minimum requirements for bail-in capital as an insufficient remedy for defunct private sector involvement under the European bank resolution framework | Semantic Scholar PDF] Why MREL won't help much: minimum requirements for bail-in capital as an insufficient remedy for defunct private sector involvement under the European bank resolution framework | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/8d64ba0e0f4d63ac57d924b284ddc43419474876/24-Table2-1.png)

PDF] Why MREL won't help much: minimum requirements for bail-in capital as an insufficient remedy for defunct private sector involvement under the European bank resolution framework | Semantic Scholar

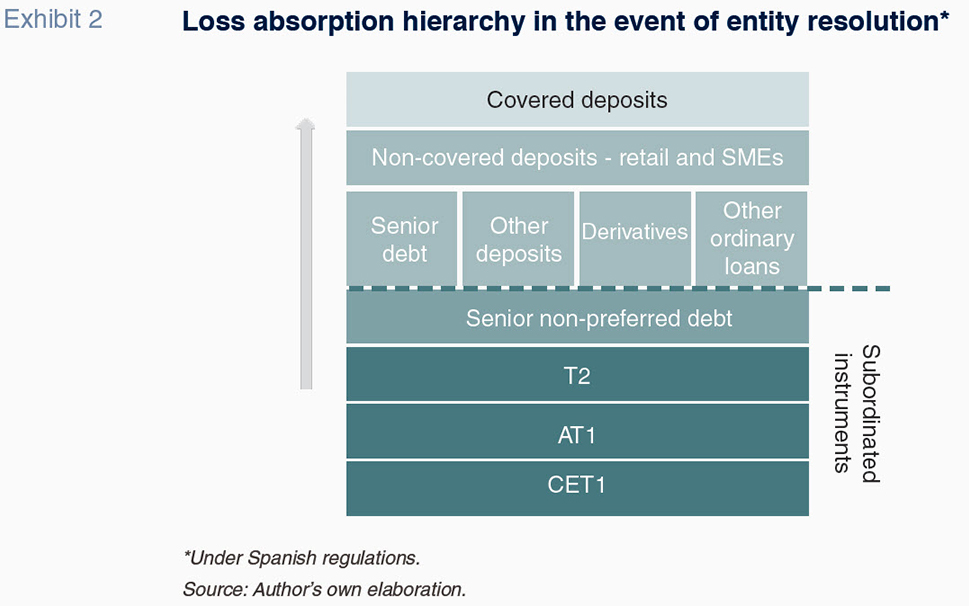

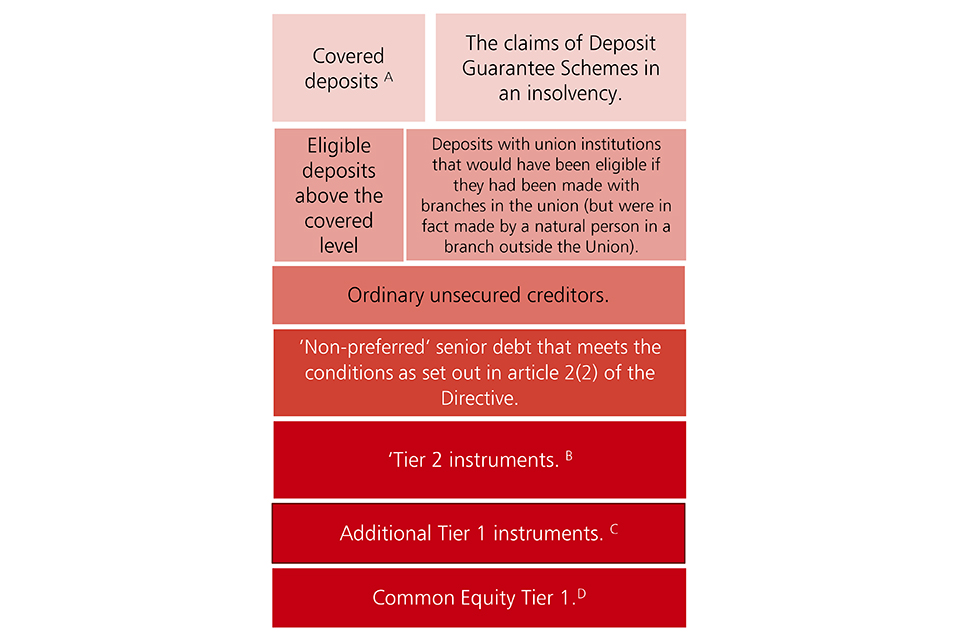

PS30/16 - The minimum requirement for own funds and eligible liabilities ( MREL) - buffers and Threshold Conditions | PS30/16 - The minimum requirement for own funds and eligible liabilities (MREL) - buffers

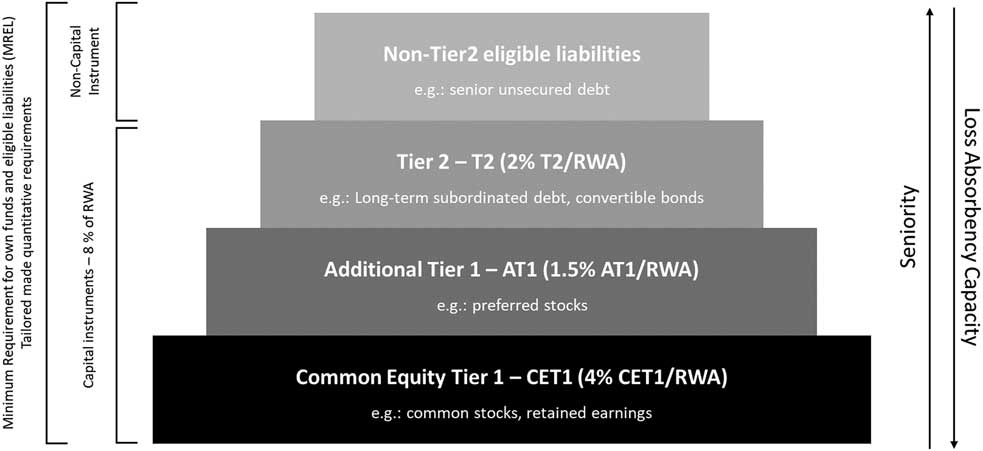

Bail-inable securities and financial contracting: can contracts discipline bankers? | European Journal of Risk Regulation | Cambridge Core